Bain Report highlights strange times for Private Equity ⏳

Ex-McK Associate recounts departure | Signs of M&A recovery in US

Exec SumCVC eyes EY's Italian consulting arm

KKR accelerates Asset Monetisation amid market recovery

AI places Consulting’s hourly pricing model at risk

👀 What to expect: ~1,200 words / ~6 min read

Industry NewsThe News 📰

CVC eyes EY's Italian consulting arm - CVC Capital Partners has revealed it is considering acquiring EY's Italian consulting division, having just sent a public expression of interest letter to the firm. This is despite there being no current discussions between the entities and EY just last year rejecting a proposal from US private equity group TPG to break up the firm globally and take a stake in its consulting business. Read more.

KKR accelerates Asset Monetisation amid market recovery - KKR is advancing its strategies to sell significant investments or list them publicly, responding to a revived IPO and leveraged credit markets. Co-CEOs Scott Nuttall and Joseph Bae noted an uptick in activity, with expectations to expand asset management to over $1 trillion in five years, aiming to match peers like Blackstone. Read more.

AI to drive shift from hourly to value-based pricing - Tracey Shirtcliff, CEO of SCOPE Better, advocates for a shift in consulting pricing structures from traditional hourly rates to value-based pricing due to the integration of AI in consulting practices. AI's efficiency in tasks challenges the relevance of time-based billing and emphasises outcomes that reflect client value. Read more.

PwC Australia announces further job cuts - PwC Australia continues its restructuring with a significant reduction of 366 positions, affecting all service lines amid ongoing financial realignment after its tax scandal. This move, part of a $100 million cost-saving plan, aims to streamline operations and focus on core business strengths. Read more.

Australian consulting firms dominate grad rankings - Despite recent negative press and broader criticism of the industry, Australia's largest consulting firms, led by EY, remain the most popular employers for graduates, with firms achieving seven out of the top ten places. According to GradConnection, over 25% of its website users sought positions at EY, with KPMG, Capgemini, and Deloitte also ranking high. Read more.

Grant Thornton retirees contest sale terms - Retired partners of GT have escalated a dispute over the sale proceeds of the firm’s majority stake sale to New Mountain Capital. Unhappy with a plan to replace regular retirement payments with a lump sum, approximately 350 retirees hired law firms to challenge the payout terms, arguing that the calculation methods disproportionately benefit current partners. In response, management has offered an increased financial incentive to forego arbitration. Read more.

US Investment Banking sees recovery - Morgan Stanley (and other major US banks report a resurgence in investment banking, with MS’s IB fees up 16% in Q1. This sector-wide uplift contrasts mixed results in equities and fixed income. The US leads this recovery, with Europe and Asia lagging. Read more.

Deloitte reverses Covid cuts by expanding office space in London - Deloitte has increased its central London office footprint by nearly 20%, reflecting a shift back to office working, reversing pandemic-era space reductions. Read more.

Best of the rest: Accenture invests in AI Robotics startup Sanctuary AI, Kearney nearly doubles Sustainability client work in 2023, Altman Solon names new Managing Partners, KPMG hands CEO Yates another three years, Consulting clients look elsewhere as trust in big four plummets.

Interesting Detours 🔗

This article recounts the experiences of an ex-McKinsey Associate who left the firm after a tumultuous year and a half. With several reasons driving them to quit:

Lack of mentorship and support, which contrasted sharply with the company’s reputed culture of apprenticeship

Being thrown into demanding work without adequate training or guidance, leading to feelings of isolation and inadequate preparation

Poor work-life balance, with typical workdays extending from early morning until late at night

A hostile work environment, with instances of partners and associate partners belittling and ridiculing staff over mistakes, contributing to toxic atmosphere

The Coffee Break ☕️

Report Review 📖

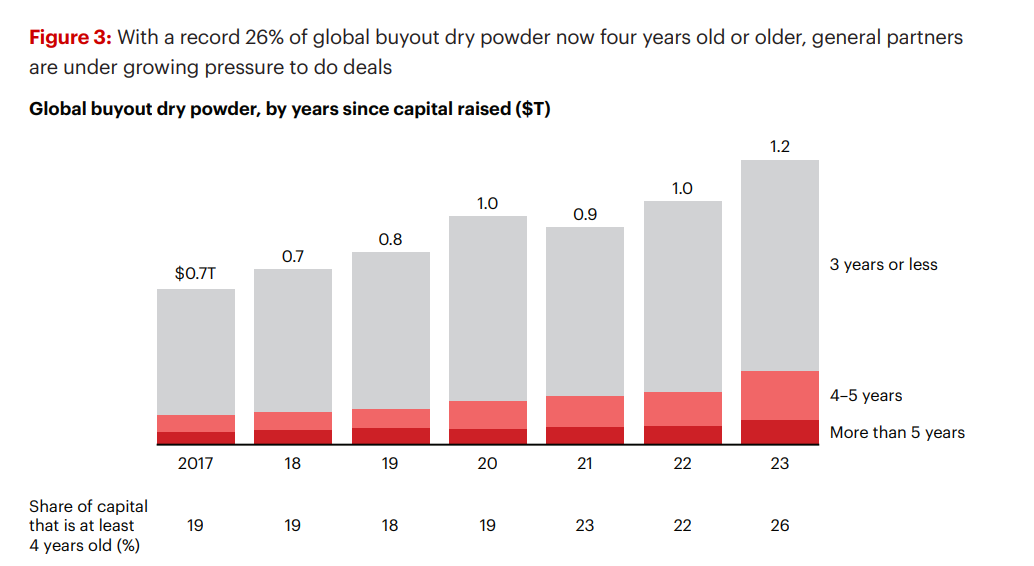

Bain's Global PE Report outlines how rising interest rates and elevated macro uncertainty has led to significant fundraising challenges for GPs, and that a strategic refocus may be required to achieve desired returns in 2024 and beyond. The market has stalled but with record dry powder in the wings and interest rates stable, there is potential for the market to rebound later this year.

KTAs:

GPs hit pause in 2023 due to the speed and magnitude of the 525bp increase in US interest rates from Mar ‘22 - Jul ‘23

Despite high demand for capital, the fundraising imbalance in 2024 was the worst in over a decade, with only $1.00 raised for every $2.40 targeted

A small number of buyouts funds saw a steep surge in LP dollar commitments in 2023, with just 20 funds accounting for over 50% of buyout capital raised

Dry powder is at a record high, with buyout funds alone holding $1.2 trillion and 26% being 4 years old or older

Targeting Returns:

Exit challenges have abounded, prompting firms to enhance value creation strategies and come up with innovative liquidity solutions to boost returns and prepare for future exits

PE’s historic reliance on rising multiples and revenue gains to generate returns may suffer in the context of rising interest rates, which has previously fueled strategies over the past decade

Firms are advised to refine their investment strategies, focusing on diversification, asset class allocations and portfolio construction

Jobs board 💼

LEK (US)

Lateral Associate (Aug or Oct ’24 Start)

This week’s edition is brought to you by:

CSRN is a not-for-profit organisation that connects students that are looking to make an impact, build new skills, and gain consulting experience with 500+ charities and NGOs across the world in need of support. If you’re interested in getting involved, please reach out to the team here.

Working EffectivelyTech Tools 💾

Look out for next week’s issue that will launch our referral program.

In it, you’ll receive the Top 40 AI tools for Consultants as well as an explanation of the other resources that are available, including the Consulting AI Call Guide Builder and the Top 50 Pieces of Software for Consultants, among a number of other resources and databases.

Keep an eye out for that email dropping in your inbox!

Excel Shortcuts 💻

Select the Current Data Region:

Ctrl + Shift + * / Ctrl + Shift + 8What it does: Quickly selects all the data around your current cell, as long as the data is contiguous (i.e., no empty rows or columns separating the data)

When to use: It's especially useful for applying formats, creating charts, or analysing data that is grouped together

That’s all folks. Don’t forget your timesheets.

BTO Team

Submit anonymous feedback: Love it | It’s great | Good | Okay-ish | Stop it